News and blog

Consistency, consistency, consistency in REITs alpha generation

The Kania Global Real Estate CAI Index, an alternative beta index based on factors relevant to real estate and real estate securities and not general equity market factors, has generated a significant and consistent live outperformance to benchmark of appox +450bps per annum, consistently over 1-, 3- and 5-year time periods.

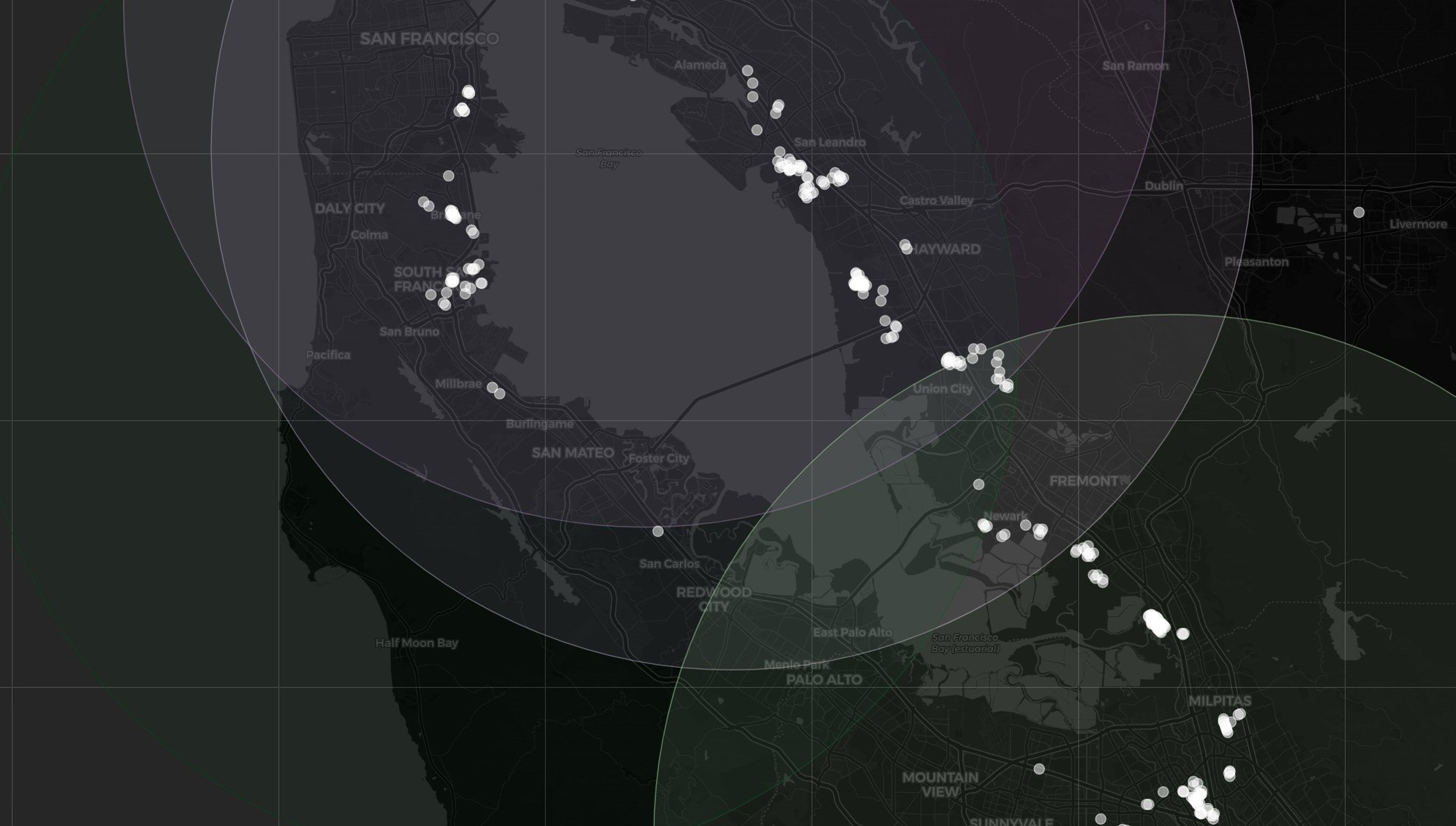

Is geo(location) impact coming to logistics?

Should investors be more selective now as market conditions change rapidly due to changing economic environment and at the same time a significant rise in transportation costs. Geolocation might become an increasingly important factor and competitive advantage in logistics during the next phase of the cycle.

Flood Risks in Listed Data Centers REITs

Data centers are vital to any organization’s operations. Organizations centralize IT operations and equipment, store, process, and disseminate data and applications and their proprietary assets in data centers. In this note, we estimate physical climate change risks related to floods in global listed data centers REITs.

Kania Advisors launches analytics for global listed real assets

Kania Advisors launches analytics for global listed real assets allowing users to leverage the firm’s specialist capabilities and specific factors with their own expertise and data.

REITS: The Real Real Estate Factors

“We believe that some sectors, like listed real estate, are sufficiently different fundamentally to make general equity market factors potentially inconsistent with the asset class and sub-optimal to capitalize on systematic sources of returns in those sectors.” comments Witold Witkiewicz

REITS: Basic networks of global REITs

In financial markets where assets, e.g. equities, are traded simultaneously the main approach to detect similarities and differences in price return patterns is to study correlation (or covariance) matrices. However, correlation matrices lack the notion of hierarchy, an important piece of information useful for investigating the evolution of asset prices.

REITS and Real Assets: Building AI Manager

Kania Advisors, London-based research and advisory firm focused exclusively on institutional real assets allocations and investment programmes is expanding its analytics to combine the firm’s sector specific factor-based solutions with AI methods to include forward-looking information flow. The combined analytical solutions will form a separate product and will not affect the current factor-based analytics that are used for the firm’s multi-factor alternative beta indices.