Share of declining logistics locations in Europe has doubled compared to 5 years ago

The share of freight handling locations across Europe experiencing declining volumes has doubled compared to 5 years ago. This is likely to result in a wider range of return outcomes for investors with exposures to the sector with the impact likely to become more noticeable in the coming quarters and as leases roll over for assets located in the proximity of those locations if economic conditions do not improve.

Consistency, consistency, consistency in REITs alpha generation

The Kania Global Real Estate CAI Index, an alternative beta index based on factors relevant to real estate and real estate securities and not general equity market factors, has generated a significant and consistent live outperformance to benchmark of appox +450bps per annum, consistently over 1-, 3- and 5-year time periods.

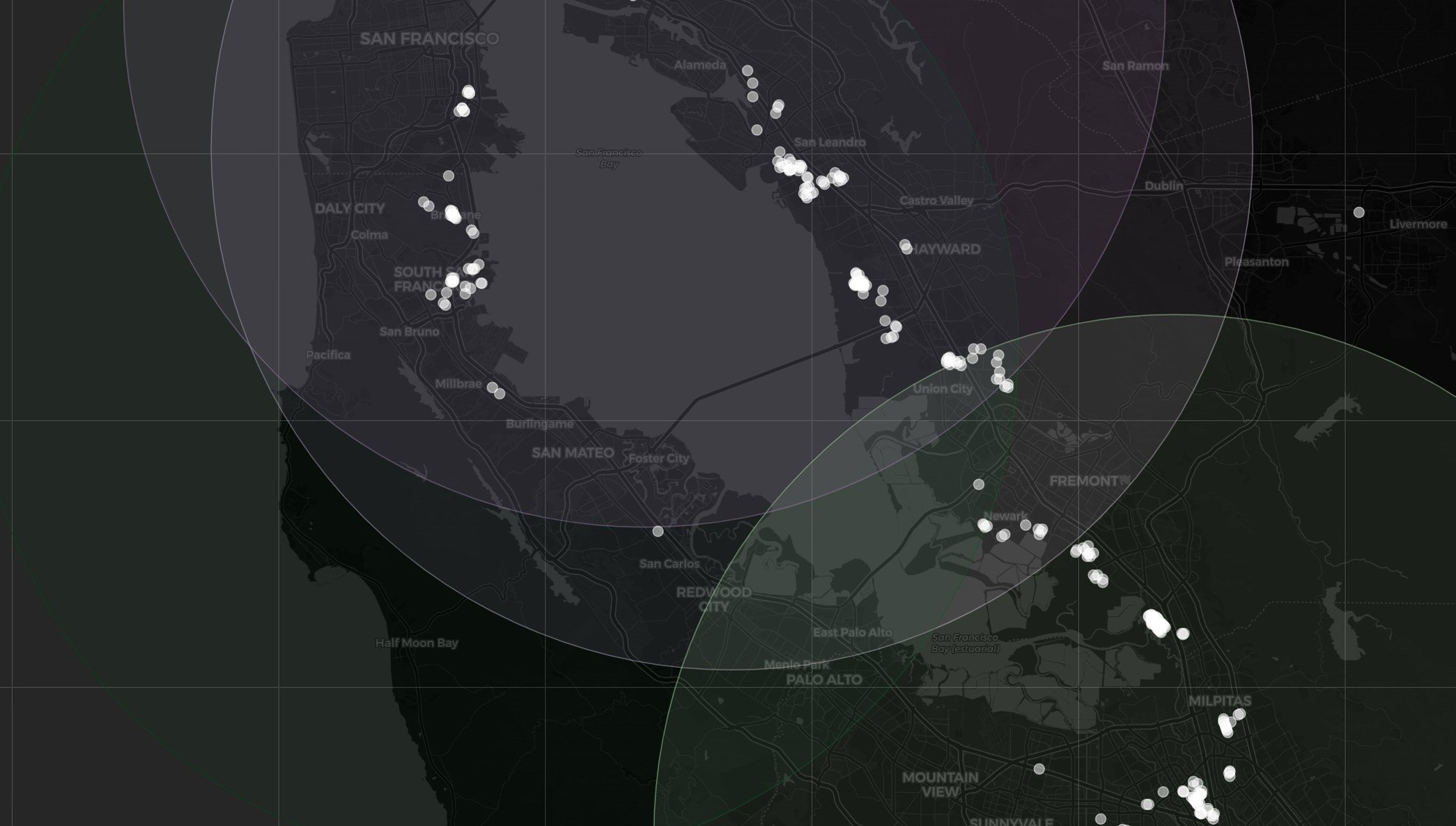

Is geo(location) impact coming to logistics?

Should investors be more selective now as market conditions change rapidly due to changing economic environment and at the same time a significant rise in transportation costs. Geolocation might become an increasingly important factor and competitive advantage in logistics during the next phase of the cycle.

REITS: The Real Real Estate Factors

“We believe that some sectors, like listed real estate, are sufficiently different fundamentally to make general equity market factors potentially inconsistent with the asset class and sub-optimal to capitalize on systematic sources of returns in those sectors.” comments Witold Witkiewicz

REITS and Real Assets: Building AI Manager

Kania Advisors, London-based research and advisory firm focused exclusively on institutional real assets allocations and investment programmes is expanding its analytics to combine the firm’s sector specific factor-based solutions with AI methods to include forward-looking information flow. The combined analytical solutions will form a separate product and will not affect the current factor-based analytics that are used for the firm’s multi-factor alternative beta indices.

REITS: Summing up a decade of active management, "Why won't active managers pick stocks?"

"Looking at portfolio construction practices in global real estate securities funds over the past decade-plus, the one thing that asset owners probably want to ask about their actively managed allocations is "Why won't active managers pick stocks?" comments Witold Witkiewicz, Founder of Kania Advisors.

Strong factor-driven performance for Kania Global Agriculture CAI Index

Kania Global Agriculture CAI Index outperformed its market-cap weighted benchmark by 182bps in the month of June 2019, taking the 3-month and 6-month (and YTD) outperformance to 118bps and 514bps respectively.