What has been better for global reits management, value or trend?

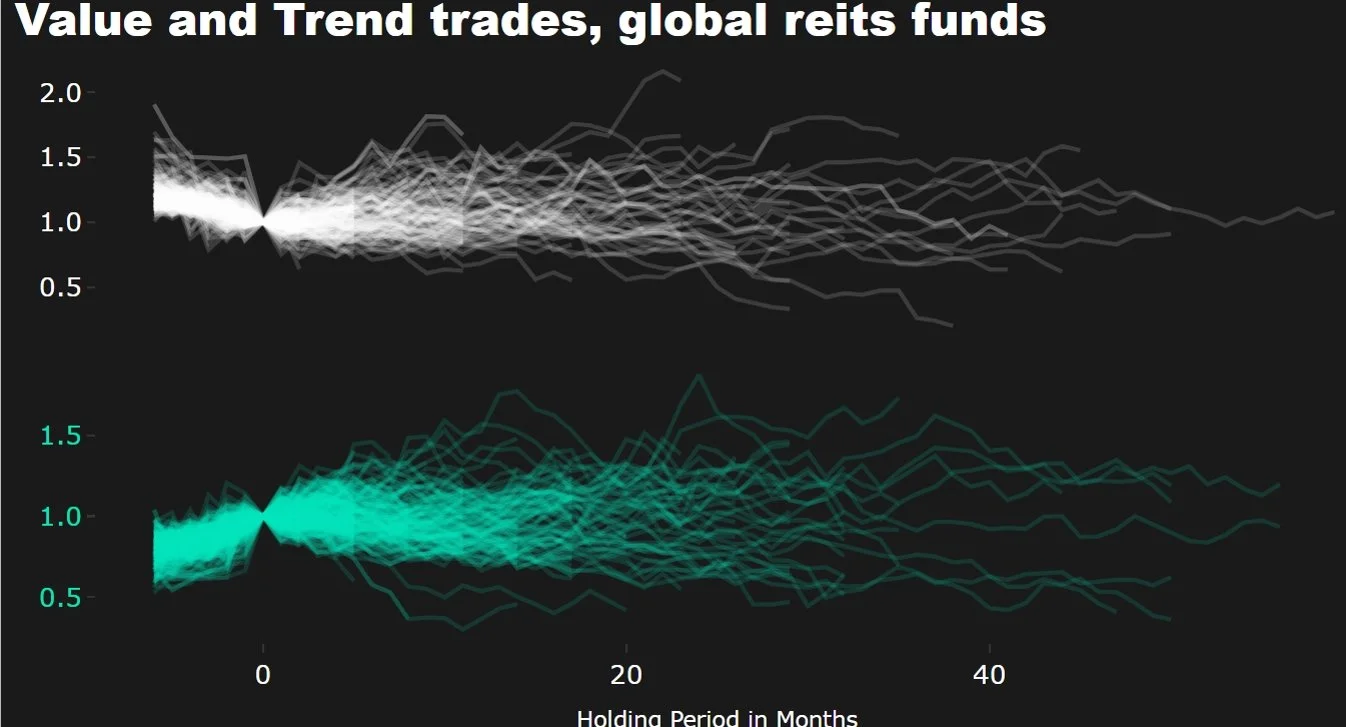

The below chart illustrates the composition of trades in main global reits funds based on portfolio holdings (SEC filings) over the past 5.5 years, between Dec'19 and Jun'25, ca 1.4K trades by holding period and by category; total return performance relative to benchmark prior to trade date at t0 and during holding period until exit.

Neither value trades (stocks entered by funds that exhibit relatively strong underperformance to benchmark up to 6m prior to trade) nor trend following trades (stocks entered by funds that exhibit relatively strong outperformance to benchmark up to 6m prior to trade) have on average persisted post trade date resulting in no meaningful alpha captured over the past 5 years by most global reits funds.