Alternative data can improve economic forecasts

Alternative data nowcasting of economic activity can improve forecasts and lead to better investment decisions, capital allocation and risk management.

Analyzing freight traffic’s impact on logistics asset pricing

Analyzing freight traffic’s impact on logistics asset pricing

Specialist data can boost alpha in combination with fundamental process

Specialist data can boost alpha in combination with fundamental process

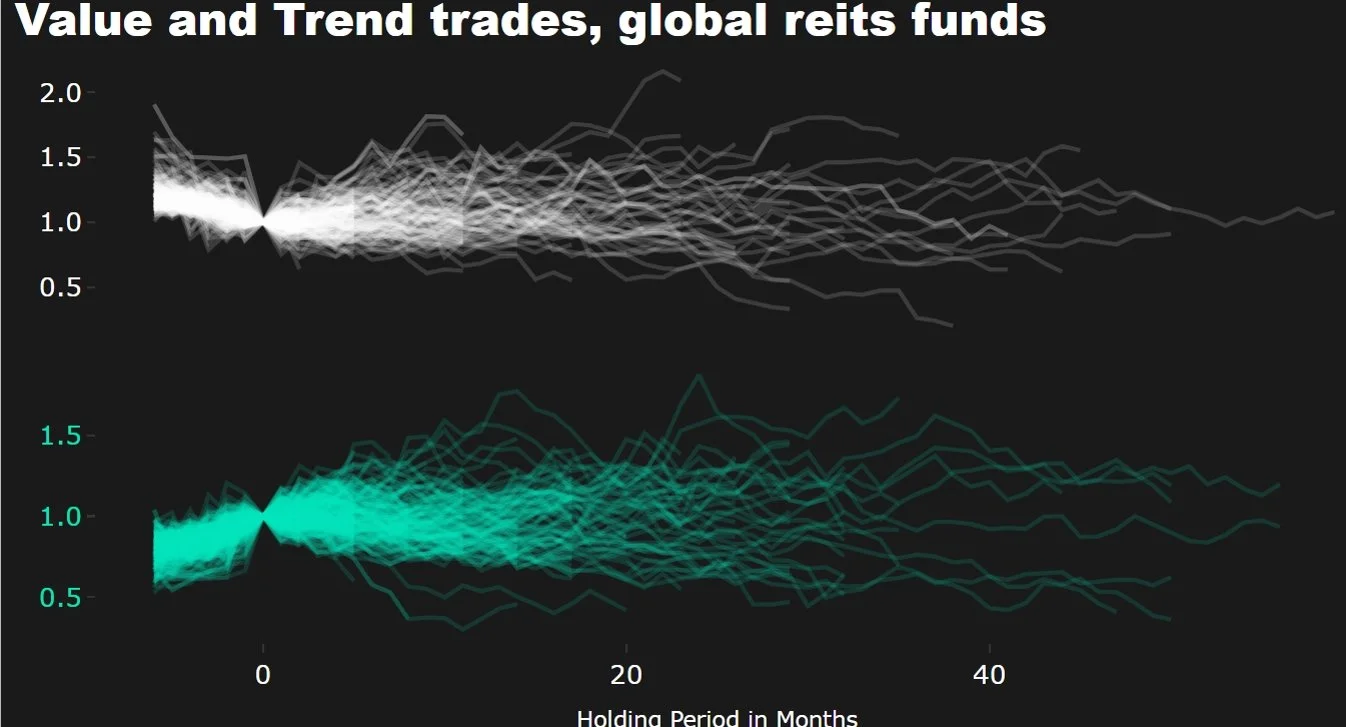

What has been better for global reits management, value or trend?

What has been better for global reits management, value or trend?

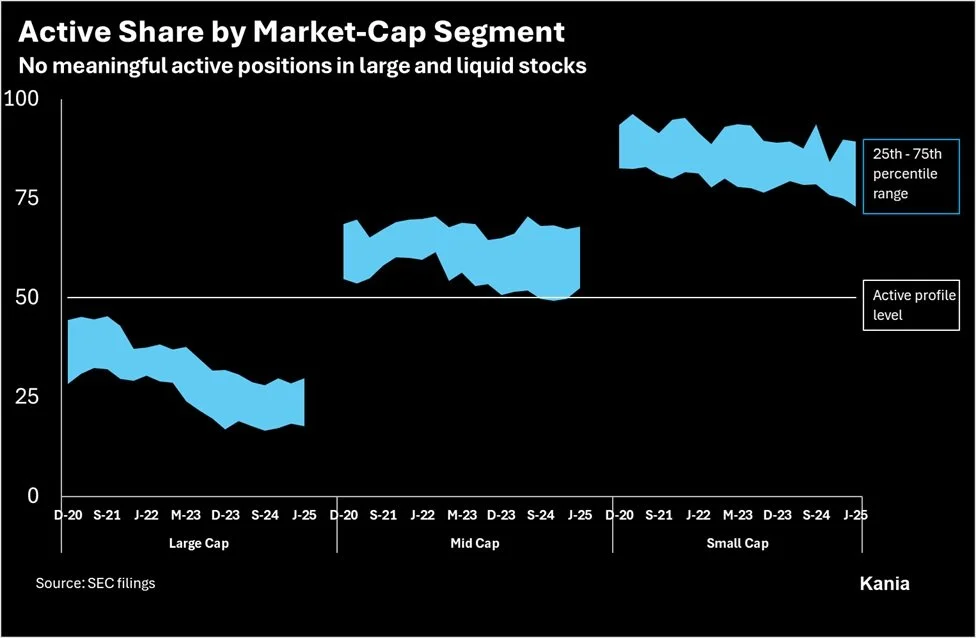

State of active management in global REITs funds

State of active management in global REITs funds

Alpha and persistence of KAFS information in listed real estate securities markets

Alpha and persistence of KAFS information in listed real estate securities markets.

Accounting for tenant default dynamics in logistics real estate

Using alternative data for logistics markets analytics