Deploying ML to predict investment patterns in REIT funds

ML models can help to predict investment patterns in actively managed REIT funds and help analysts and investors to both stay ahead of likely trends and potentially harvest additional alpha from systematic or more focused approach to trading.

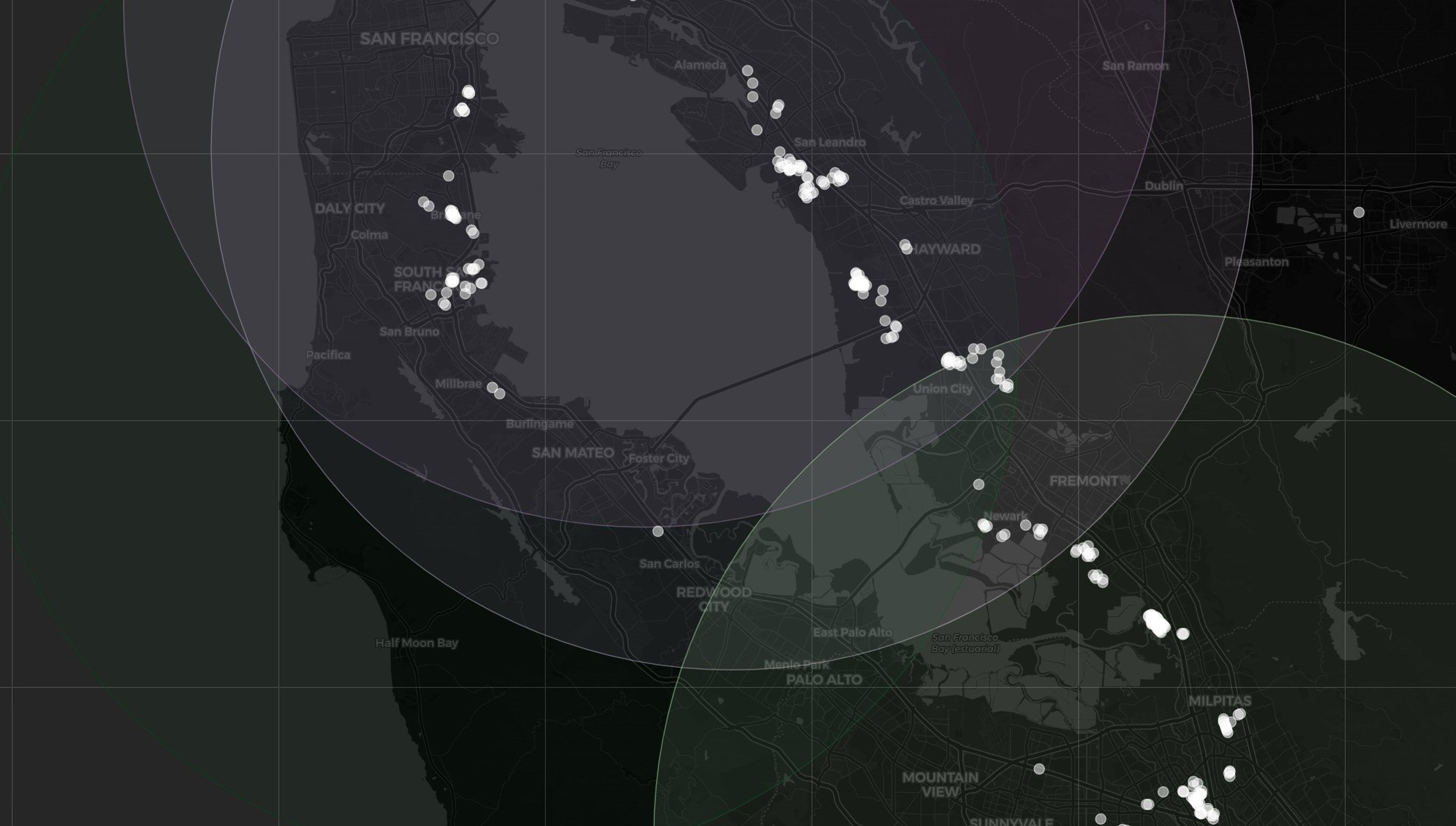

Road transport activity around logistics assets declined in the first 3Q

Road transport activity around logistics assets fell by ca -0.5% on average in the period until September compared to the same period last year. UK and Ireland and Benelux where the two regions that recorded the largest declines of -2.4% and -1.1% respectively.

Persistence of real estate factors in equity markets

There is significant and highly persistent component of real estate factors in listed equity markets that investors can target in a consistent and repeatable way to harvest alpha in listed real estate securities allocations irrespective of equity market conditions.

Climate resilient alpha in listed real estate allocations

As climate related risk considerations move higher up on most agendas, investors might want to gain exposure to listed real estate allocations that are aligned with their strategic climate goals and at the same time offer consistent opportunities for excess returns.

Get your Fact(or)s right, how investors can boost alpha in their REITs allocations

Investors in listed real estate can harvest more alpha form their allocations by exposure to factors that drive returns of real estate

Ahead of the curve, impact of freight volumes on logistics rents

Changes in freight volumes is an important indicator of future rental growth prospects for logistics markets a year in advance.

Share of declining logistics locations in Europe has doubled compared to 5 years ago

The share of freight handling locations across Europe experiencing declining volumes has doubled compared to 5 years ago. This is likely to result in a wider range of return outcomes for investors with exposures to the sector with the impact likely to become more noticeable in the coming quarters and as leases roll over for assets located in the proximity of those locations if economic conditions do not improve.

Consistency, consistency, consistency in REITs alpha generation

The Kania Global Real Estate CAI Index, an alternative beta index based on factors relevant to real estate and real estate securities and not general equity market factors, has generated a significant and consistent live outperformance to benchmark of appox +450bps per annum, consistently over 1-, 3- and 5-year time periods.