Case Study: Submarket and geolocation intelligence for logistics real estate

Case Study

As logistics markets adjust to the next phase of the cycle with investors’ focus shifting from “market beta” exposures and allocations to detailed assessments of specific geolocations of assets, alternative data can help to provide unique and increasingly critical insights that were previously unavailable to guide investment decisions, geolocation selection as well as monitoring logistics activity in new ways to gain competitive advantage and early indications of changing activity patterns that impact demand, cash flow generation potential and ultimately values of logistics assets. Granular information specific to separate submarkets and individual assets at geolocation can help to guide investment, ongoing asset management and risk management decisions. For investors new data driven insights provide new opportunities to further optimise business operations through the lifecycle of assets and financial performance outcomes.

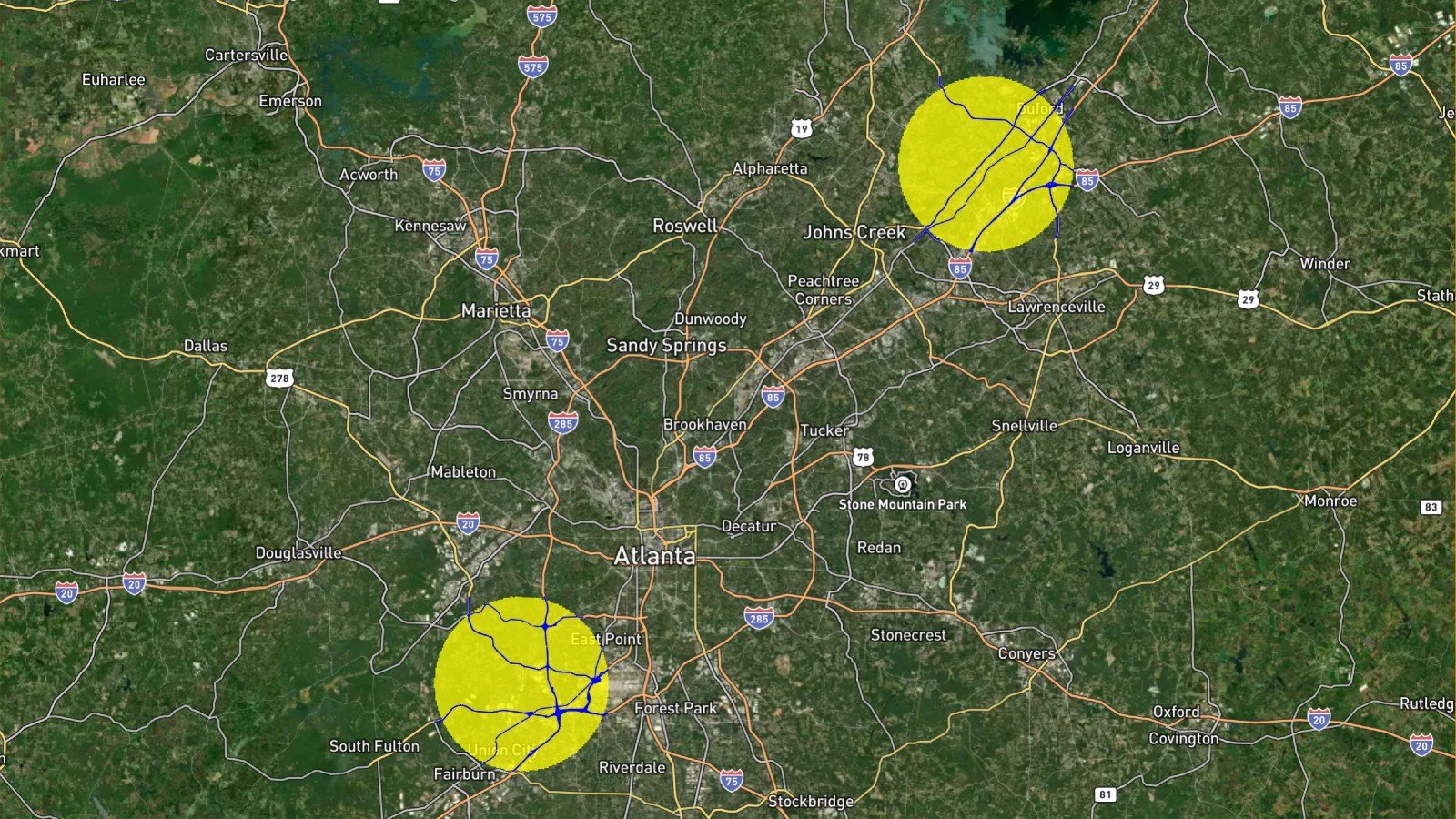

Kania Advisors recently provided detailed analytics to a US-based private equity investment firm to assess submarket and geolocation attributes of logistics activity for a number of areas of interest (AOI) across Dallas Fort-Worth and Atlanta markets. We combined a number of metrics, from market level to geolocation specific logistics activity.

we analysed general market activity in terms of freight volumes across main freight handling locations

we analysed drive-time weighted freight volumes to each AOI (depending on the number of freight handling locations within a specified isochrone, this creates a “network” flow to the AOI)

we combined this information with our proprietary data monitoring transport traffic flows on main transport distribution roads within those defined AOIs, this provides the most granular indication of how attractive a submarket or asset geolocation is and any changes to activity and competitive position of that geolocation within a market as, of course, transport traffic has to pass within a radius of an asset to reach it.

The charts below illustrate two of the AOIs for each market, selected at opposite sides of the respective market for illustration purposes, along with profiles for transport traffic flows measured within the highlighted areas.

It is clear that looking at market level information only such as headline rents, take-up, vacancy etc. does not provide the level of geolocation detail that investors increasingly need to make business decisions. As the charts illustrate, in both markets there are submarkets/geolocations that have exhibited a higher level of stability in logistics activity and there are those that are changing in a relatively meaningful way with road transport activity declining over the past 1-1.5 years.

This information provided unique granular insights to understand, benchmark and compare both logistics market dynamics and specific asset geolocation attributes.

Freight volumes flows in a market and road transport activity are the main leading indicators of rental growth for logistics markets providing 1-1.5 year leading information of rental growth and ultimately values of logistics assets. For investors, using new alternative data to gain granular live information regarding their specific assets or geolocations when evaluating potential investment opportunities is critical to optimise financial outcomes throughout the life cycle of an investment.

Dallas Fort-Worth, AOIs

Dallas Fort-Worth, Daily Transport Traffic Flows within AOIs

Atlanta, AOIs

Atlanta, Daily Transport Traffic Flows within AOIs

If you are interested in complementing your business insights and processes with alternative data specific to your assets or potential transactions, please contact info@kaniaadvisors.com

Data and analytics

Freight volumes and road transport activity are a leading indicator of logistics rental growth with ca 1-1.5 year lead time, see previous notes.

Kania Advisors logistics analytics is built to provide allocators and investors with live access to monitor logistics activity that drives market rents and asset values from macroeconomic conditions to specific geolocation. Our analytics and data tracks any market, any location and any asset (or potential asset such as land plots), across Europe and the US, and provides;

- information of logistics activity at cargo handling locations across the continents,

- information on volume of goods flowing across any market

- road transport activity of how goods are distributed across markets and main distribution road network

- road transport activity and longer term trends in the vicinity of any asset

- asset level competitive metrics such as population reach within 30min and 60min drive times, drive time weighted distance to cargo handling locations, access and density of transport distribution routes

- overlay with macroeconomic and demographic data and/or user specific data

- ML algorithms to identify clusters and tail risks across portfolios

- ability to benchmark an assets' competitive position compared to institutional quality logistics assets across markets

About Kania Advisors

Kania Advisors is an independent research and advisory firm focused exclusively on institutional real assets allocations and investment programmes. We provide advice and solutions to improve outcomes in real assets investment programmes. We conduct detailed industry research and custom studies typically focused on quantitative analysis and provide insights which form a critical part of a client's decision process.